The need to keep track of your own finances and plan a budget sooner or later arises before every modern person. Banking applications allow you to analyze expenses and receipts to an account for a specified period, but since there are often several cards and we still use cash, to complete the picture you will need to collect information together.

Properly organized home accounting will make it easy to track the cash flow of each family member, control expenses, refrain from useless spending, and also think through and properly distribute finances. Today, users have access to a variety of software for accounting for personal funds and the capital of the whole family. Let’s look at the best home accounting apps that can be used on both your computer and mobile device.

Contents

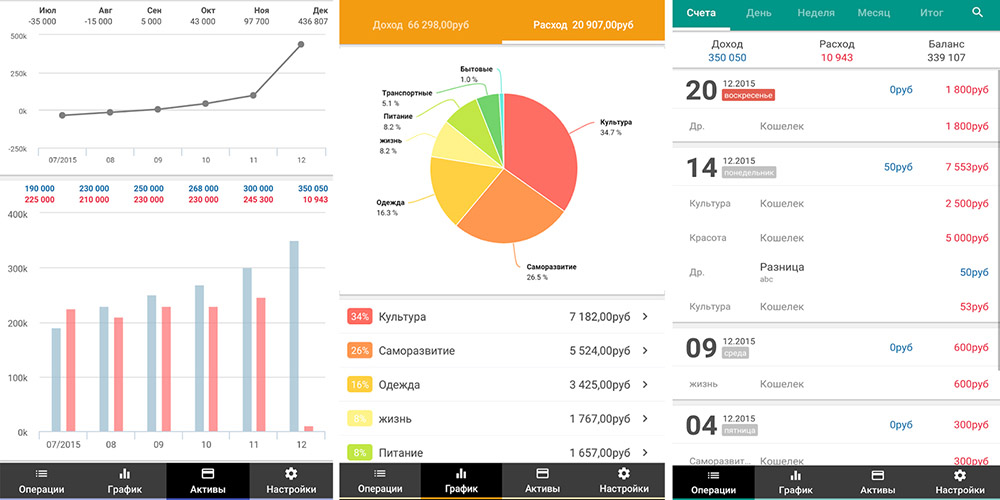

MoneyManager

An excellent program for managing finances that can be installed on both a smartphone (Android, iOS) and a PC. Using the software, you can control income and expenses using convenient infographics, distribute income and expenses by category, and also view the movement of funds by month and statistics. The program for home accounting is available for free with limited functionality and contains advertising.

The application functionality offers the following features:

- tracking the distribution of funds by category, financial flow statistics;

- accounting of assets and movement of funds from account to account;

- setting parameters, creating repeating operations;

- credit and debit card management;

- backup, sending by mail, restoring from files;

- Protecting the application with a password.

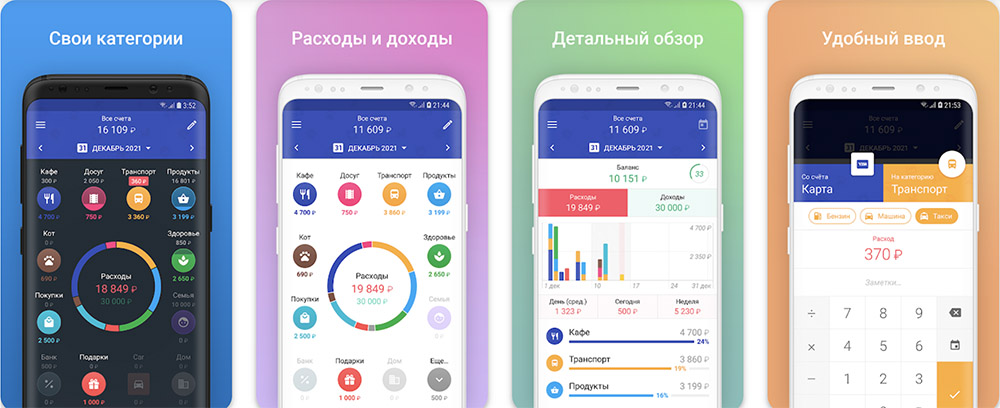

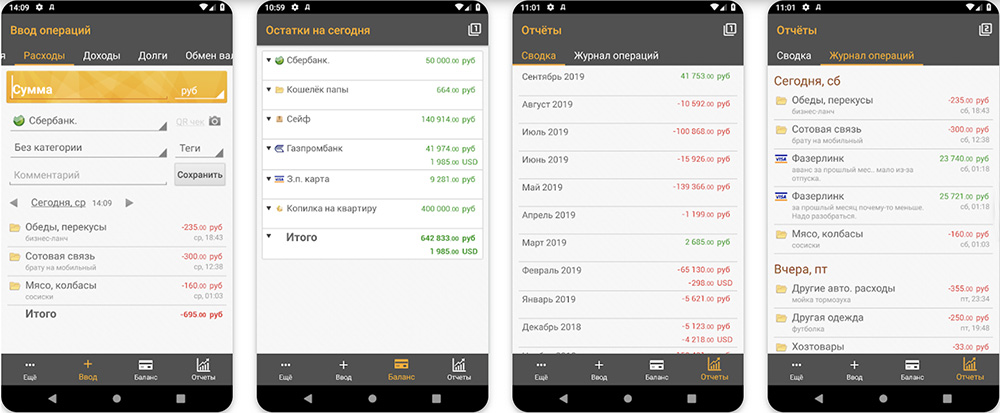

1Money: expenses finance budget

The best option if you need to account for and organize the budget of the whole family. The mobile application has a simple, user-friendly interface and allows you to analyze data from different devices through one account, track the movement of finances and optimize spending. The free version has restrictions on the number of accounts and categories; when purchasing a paid subscription, they are removed, and the ability to synchronize, automatically predict expenses and other options are added.

Functionality includes:

- visual representation of the balance of all accounts, expenses and receipts;

- detailed statistics;

- cloud data synchronization;

- reminders about regular payments;

- multicurrency;

- adding your own categories, customizing the interface design.

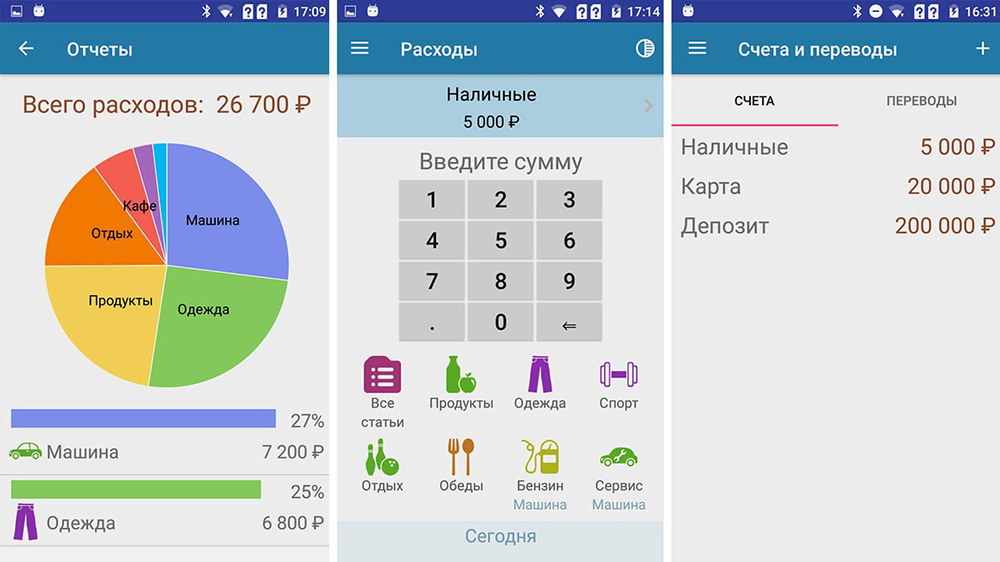

Finance – budget, expenses

A mobile application to control your finances, allowing you to track your financial performance, manage your budget, take into account income and expenses, as well as optimize and plan the further distribution of funds. The Finance program is available to Android and iOS users for free (there are ads) and includes in-app purchases.

Main functions of the program:

- visual representation of financial movements in the form of a diagram;

- detailed analysis of expenses and revenues;

- working with different currencies;

- use of templates, the ability to create your own categories;

- payment reminders;

- password protection.

Wallet – money, budget

A program for maintaining a family budget for a computer, tablet, phone (Android, iOS) and Android Wear watch. This is one of the best tools for tracking the income of both one person and the whole family. The application allows you to set up synchronization with the bank for automatic payments. The functionality in the free version is limited; to remove restrictions, including connecting other users to maintain a joint budget, you will need to purchase a subscription.

The software offers the following features:

- synchronization between devices;

- automatic import of banking transactions;

- creating detailed reports with charts and reviews, sending by email;

- support for different currencies;

- editing categories, templates;

- storage of loyalty cards, receipts, guarantee documents;

- export data to CSV, XLS and PDF.

Monefy – budget manager

One of the best options for Android and iOS if you need to track the finances of all family members or just need access to data from different devices. With Monefy, it’s easy to control expenses and plan a budget, and all adjustments made are synchronized between your devices. The application is available in a free version with reduced functionality and as a subscription, with which the capabilities are significantly expanded.

Among the program’s functions:

- shared access, synchronization via cloud storage;

- data backup, export;

- payment reminders;

- adding new categories;

- password protection;

- support for different currencies.

Money OK

A convenient personal finance accounting program for your home that allows you to control cash flow and plan a budget without wasting money on unnecessary purchases. Income and expenses in the application are entered manually. The free version includes standard tools for analysis and planning, the extended version offers additional functionality (analytics for the year, week, widget, more icons, etc.).

Main functionality:

- synchronization between devices;

- adding categories;

- support for different currencies;

- generation of reports for the selected period, export of tables to Excel;

- payment reminders.

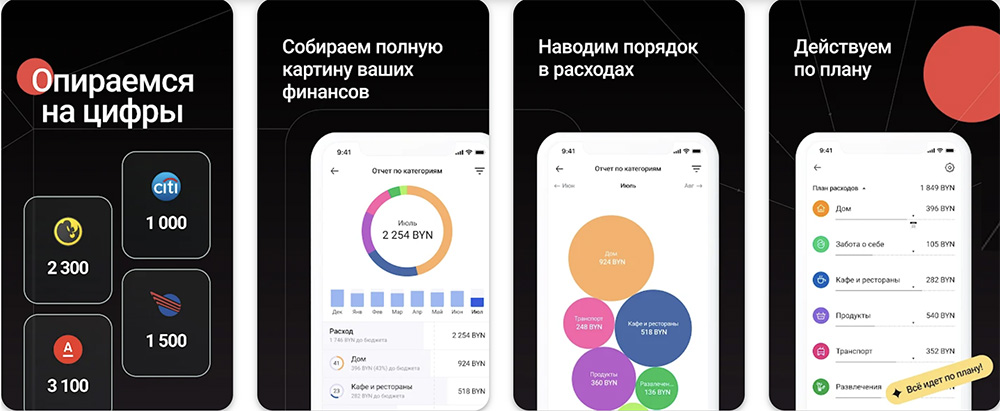

Zen money: cost accounting

Another excellent tool for effectively managing personal finances and the budget of the whole family with the functions of linking bank cards, electronic wallets, as well as the ability to separate accounts into personal and general. With the help of Zen Money, you can keep track of monetary assets in different currencies, track debts and loans, analyze financial indicators and plan expenses. The application is shareware and available for Android, iOS, there is also a web version. You can expand the functionality by subscription.

The following features are available to you with the application:

- detailed analytics in the form of visual diagrams;

- automatic import of transactions using bank cards and electronic money;

- data synchronization between platforms;

- payment reminders;

- support for different currencies, including cryptocurrencies;

- bot assistant in Telegram.

Rubbish: cost accounting

The application helps you keep track of income and expenses in different currencies, entering data using categories and subcategories, as well as track debts and loans, plan a budget, control savings and investments, and set goals. You can set up recognition of messages from the bank so that the data is entered automatically. The main tools are available for free, and additional functionality, including the ability to keep records on different devices, is provided by subscription.

- bookkeeping in different currencies and on different accounts;

- reminders about upcoming payments, shopping lists;

- tracking savings and investments;

- connecting multiple users;

- synchronization with banks;

- scanning receipts;

- password and pin code protection.

In conclusion, we note that the best program for home accounting is different for each user, since the choice is not determined by ratings and reviews, but always depends on individual needs and preferences. Free and paid apps offer different features and levels of support, including, in addition to the standard set of options, additional tools that you may or may not need.

The interface is also a matter of convenience, so to understand how convenient and functional the program is, evaluate it using the demo version. When choosing the most suitable software for yourself, take these points into account, and you will receive a tool that will help you put your finances in order as efficiently as possible.

What criteria do you focus on when choosing an application for home accounting? Are you looking at functionality or rating? Share in the comments.