Make me a Bizum . You have probably heard that phrase recently. Bizum has made a major change in the way we send and receive money with other people. Its popularity is so great that many companies are implementing it as a valid payment method. Even now it is possible to send money to charities. If you want to know everything about this service, here you will find a complete guide with the most frequently asked questions about Bizum and their answers.

Contents

WHAT IS BIZUM AND HOW DOES IT WORK?

Bizum is a payment platform that enables the sending of money between two users or entities immediately. Currently, it has 17,213,000 users in my country, the only country where the service is available. It has 33 affiliated banking entities and is used by almost 20,000 online businesses . In addition, 4,272 non-governmental organizations (NGOs) can receive donations through this medium.

Bizum was born in 2016 with the aim of facilitating the sending of money, even among users who were not clients of the same bank. The premise was to create a universal, simple payment platform that would have an immediate operation. In 2017, it reached an important milestone: Bizum reached one million users. In 2018, its developers enabled the sending of money to NGOs by private clients and, just one year later, Bizum landed in online stores. Just four years of existence, it managed to exceed 10 million users.

The operation of the system is very simple. The user must link their phone number to the Bizum account . When you want to send money, you must do so by indicating the number of the other user. In the same way, to receive money you must provide your number to the other person. Of course, the service has some limitations that it is necessary to review.

- Cannot send less than 0.50 euros

- You cannot send more than 1,000 euros

- Maximum amount of transactions received per client in one day: 2,000 euros

- Number of operations received by a client in a month: 60 operations

- Maximum number of recipients to include in a multiple request / shipment: 30 recipients.

- Duration of the pending shipment to a user who is not registered: 2 days

- Duration of the pending request to an unregistered user: 7 days

- Maximum storage time of additional content on service servers: 30 days

These restrictions are general and all banks using Bizum must abide by them. However, each entity could add certain additional limitations , depending on its circumstances.

WHO IS BEHIND BIZUM?

The Bizum trademark is owned by BIZUM SL . Behind this limited company are 23 banks operating in Spain. All of them have come together to implement a standard system, unique and compatible with all entities. In addition to those 23 initial participants, Bizum is available to other banks. By way of supplementary information, you should know that Caixabank is the main shareholder, followed by BBVA and Santander.

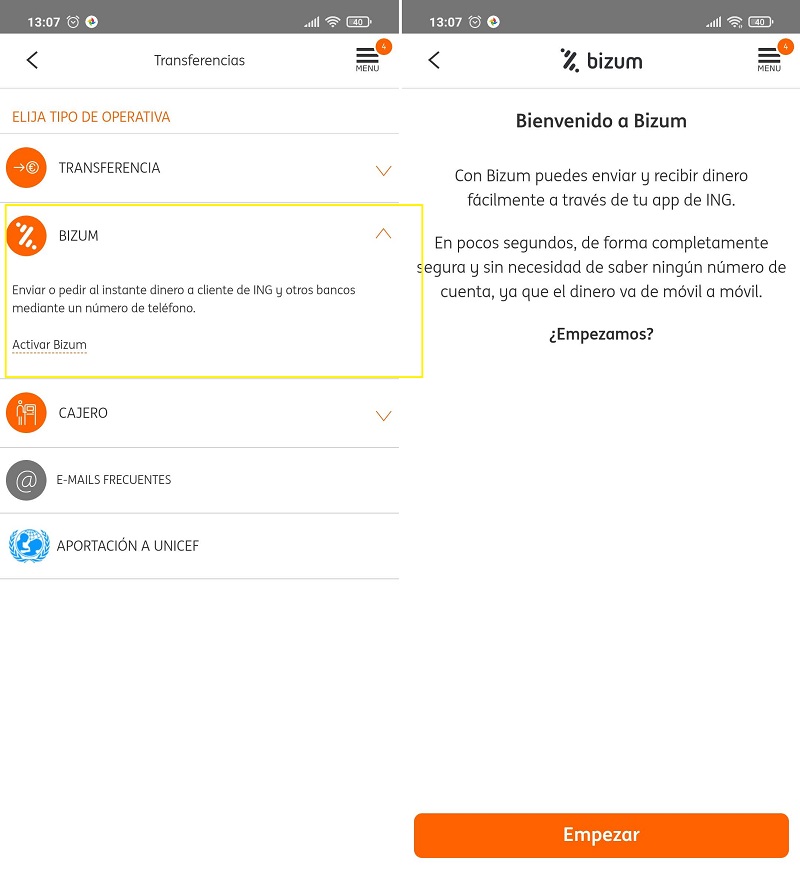

IS BIZUM AN APPLICATION?

No. Bizum is a platform that is integrated into the respective applications of each bank . In other words: Bizum cannot be downloaded from any app store. As the company itself indicates, it is necessary to obtain the official application of the participating bank and, from there, use Bizum.

IS IT AVAILABLE ON ANDROID AND IOS?

Yes. It is compatible with all mobile operating systems, as long as the bank in question has so decided. Actually, Bizum can be used from Android, iOS, or the web . The only thing that is required is that the entity integrate it as one more function. Of course, it could always be the case that a bank that does not have mobile applications makes access to Bizum effective from its website.

CAN YOU USE BIZUM WITHOUT YOUR MOBILE?

In some cases. In reality, whether or not Bizum is available on another platform beyond mobile, for example through web access, depends on each bank. For example, BBVA does support Bizum from its website . Therefore, those who have a checking account in that entity will be able to send money without having their mobile phone at hand.

WHAT BANKS ARE COMPATIBLE WITH BIZUM?

Currently, the banks that allow you to send money with Bizum to other users are the following:

- CaixaBank / Bankia

- Santander

- BBVA

- Sabadell

- Kutxabank

- Rural Box

- Unicaja Bank

- IberCaja

- Cooperative Group Cajamar

- Abanca

- Bankinter

- Liberbank

- Kutxa Labor

- EVO

- BankingMarch

- Rural Eurobox

- Engineers Box

- Pueyo Bank

- Mediolanum

- Cajalmendralejo

- Arquia Banking

- Bankoa

- Caixa Guissona

- Caixa Ontinyent

- Cajasur

- Deutsche Bank

- Imagin

- ING

- Openbank

- Orange Bank

- Targo Bank

As you can see, the list is really extensive and includes the most popular banks. This has made it a practically universal service that the majority of Spanish citizens can access.

WHAT DO I NEED TO CREATE A BIZUM ACCOUNT?

Once you have resolved to start using Bizum, you must meet the following list of requirements.

- That your bank is compatible with the service . You can check if your entity is present in the list above.

- Have a Spanish bank account . This is essential to receive payments and send money.

- Have a Spanish phone number . You will not be able to register your Bizum account with a number that does not start with +34.

- Download your bank’s application on a mobile device .

If you meet all these requirements, you can create a Bizum account right now.

CAN YOU USE BIZUM WITH TWO BANKS AT THE SAME TIME?

No. To better understand why this is not possible, let’s remember a basic aspect of how Bizum works. To create an account in the service you can only use a phone number linked to Bizum which, in turn, will be linked to a bank account. It is only possible to have two or more Bizum accounts, and therefore use it in different banks, having more than one phone number.

HOW LONG DOES IT TAKE TO SEND MONEY TO CASH?

Sending money through Bizum is done in a matter of seconds. We can say that it is immediate, although sometimes it may take a little while. In any case, if all goes well, the transfer should be effective in less than 1 minute . Anything that exceeds that time can be considered an anomaly.

WHAT LEVEL OF SECURITY DOES BIZUM OFFER?

Bizum offers the same security systems that you already enjoy when using your bank’s services . Being fully integrated with the application of each entity, it benefits from encryption at the connection, biometric identification systems and other modern security methods. In short, Bizum is as secure a system as your bank’s own platform is.

It is quite different that, due to ignorance, the user may fall into fraud. Our colleague Juan Carlos Broncano warned us that, in the middle of 2021, many scams are still carried out through Bizum and other means. If you want to know four examples, we recommend that you take a look at the following article.

IT’S FREE?

It depends. Each bank can establish rates when using Bizum . At the moment, most entities maintain it as a free service, although some banks, such as BBVA, have shown their intention to charge for each transaction.

IS BIZUM USED TO SEND MONEY ABROAD?

No. Bizum is an entity created by Spanish banks and is designed for residents of Spain . In no case is it a feasible method to send money to family and friends who are in another country.

HOW TO CONTINUE USING IT WITH ANOTHER BANK?

It is as simple as activating Bizum with the same phone number at the other bank. The moment you carry out this process, Bizum will no longer be linked to your previous bank account.

WHAT HAPPENS IF I SEND MONEY TO SOMEONE WHO DOES NOT HAVE BIZUM?

You will be notified by SMS . The message will explain that a payment is pending through Bizum. If the recipient creates a profile in less than two days, he will receive the amount in his account. Once this time limit is exceeded, the shipment will cease to be valid. The money will come out of your account only in the event that the other user registers in Bizum, but it will not be withheld.

WHAT IF I GET THE WRONG CONTACT?

In that case, it is not possible to recover the money , unless the recipient understands that it is a mistake and returns the amount to you. If you have seen yourself in this situation, it is best to check which phone you made the shipment to and contact the person to ask them to refund the money. Another option is to request the same amount for Bizum. However, there is no way to reverse a Bizum. Therefore, it is very important that you make sure that you send your money to the correct number.

CAN YOU PAY FOR BIZUM IN PHYSICAL STORES?

Not at the moment, although it will come soon. Of course, it is not strange that some physical businesses request payments through Bizum. However, the intention is to establish an official system shortly.

AND ON THE INTERNET?

Yes. On the Internet, many companies have begun to integrate it into their stores as one more payment gateway. Here are some examples:

- Balearia

- decathlon

- Destinia

- DAY

- K-Tuin

- Logitravel

- The mermaid

- MediaMarkt

- Ulanka

- Waynabox

As you can see, these are not small companies, but large businesses. Therefore, it is expected that Bizum will be progressively implemented in more and more online stores, especially taking into account the trend.

WHAT HAPPENS IF I HAVE DONE A BIZUM, BUT THE MONEY DOES NOT ARRIVE?

The first step if it seems that the money has not arrived is to check if it is in the recipient’s account and if the withdrawal has been made in your account . If this is not the case, then it is likely that the shipment was not completed successfully. You have no choice but to repeat it. On the other hand, if you have sent money and the charge appears on your account, but not on the recipient’s, make sure you have used the correct number. If you are sure that you have sent the money to the corresponding telephone number, contact your bank to investigate the case. These are generally the most common reasons why money is not being sent successfully.